Email: [email protected]

Conventional mortgages are the most popular form of home financing for buyers in the United States. However, it may not always be clear how these loans differ from other loans, such as those provided by government agencies. To help you gain a better understanding of conventional loan basics, here is a quick guide with further information:

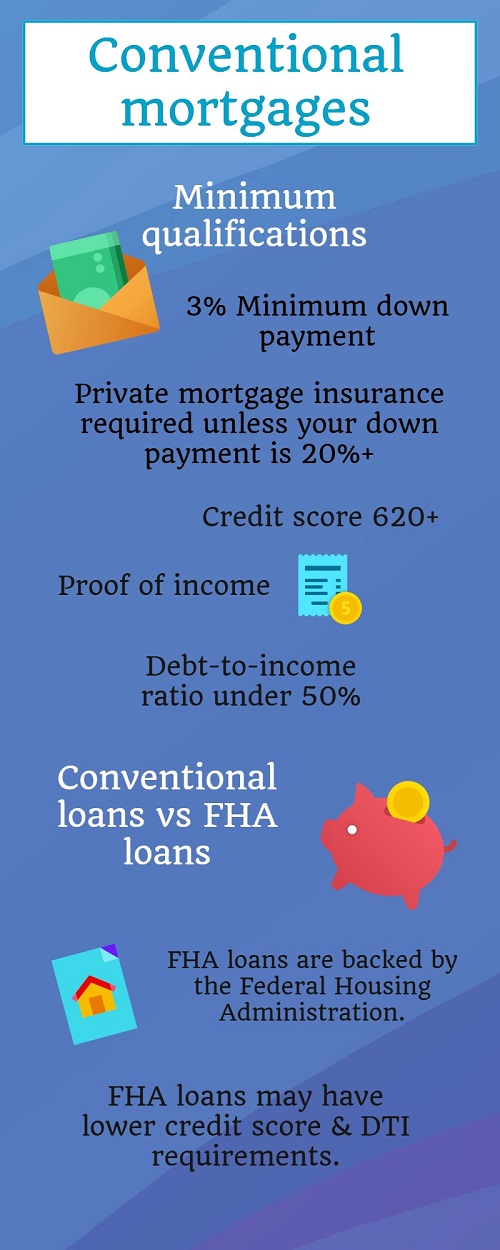

When obtaining conventional financing, your lender will examine your financial situation. The loan officer may request information including your credit score, income statements and debt to income ratios.

A down payment is required for conventional loans. Each lender has different minimum requirements, but the larger the down payment, the less money you’ll have to pay back over time.

Many believe a 20% down payment is required for conventional loans, but the minimum requirement is typically much lower. You can find mortgages with minimum down payment requirements anywhere from 3% to 20% of the overall purchase price.

Your choice of down payment amount can affect the terms of your mortgage, like interest rate or the need for private mortgage insurance.

Government-backed home loans have specific features to suit some homebuyers.

The Federal Housing Administration (FHA) is a government institution offering home loans for buyers who meet certain qualifications. Government-backed loans have advantages for those with bad credit or other financial roadblocks, but require other qualifications for approval.

Conventional mortgages tend to have higher interest rates than FHA loans, although these loans typically require borrowers to pay mortgage-insurance premiums.

Interest rates charged on a conventional mortgage vary by several factors, including the term and amount borrowed. However, interest rates are also subject to change every year based on the overall economy. Many buyers choose to wait for a period when interest rates are lower to apply for a mortgage, regardless of the loan type.

Ultimately, your choice of loan will depend on your personal circumstances. The more you know about different types of mortgage, the better equipped you’ll be for your journey into thefinancial real estate marketplace.

Lynn Butterfield is an Associate Broker at Coldwell Banker and is a Certified Real Estate Negotiator. Mr. Butterfield has 41 years of experience in real estate sales and development. His vast experience ranges from luxury sales through commercial sales and leasing. Perhaps more importantly, he focuses his attention on client success, whether he's helping someone buy their first home, or working with a developer seeking assistance to create and position a large project in the marketplace. One recent client said, "Working with Lynn is almost like working with a Real Estate Attorney, because he knows exactly what to look for, so you can be protected!" Another first-time home buyer just said, "I needed someone to hold my hand through this because it's the largest investment we'll ever make! I know he isn't in this just to make a quick buck. He really cares about his clients!"

Whether you're in the research phase at the beginning of your real estate search or you know exactly what you're looking for, you'll benefit from having a real estate professional by your side. He would be honored to put his real estate experience to work for you.